Digital Life and Death

What will your digital legacy be and who will manage your digital life once you die? Tough questions, but they don’t necessarily have to be difficult if managed, while you are in control.

Just as we should have a will that helps our loved ones deal with the assets of our life, we should now have one for our digital life. The fact is, many of our assets are digital, but have you given someone the key with which to unlock your digital life, once you are gone?

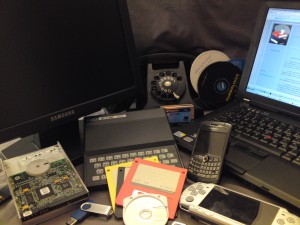

We have a large digital footprint today that is a part of our life. What is considered a digital asset? A digital asset can be your email, digital pictures, social media profiles, mobile phone, iTunes, Kindle, video games, financial assets, bitcoins, and any data files whether online or stored locally, as well as online shopping profiles, are all considered a digital asset. Now, who has access to your digital life? Is there anyone who knows what you want done with your Facebook profile for example?

You need to have a roadmap to your digital life in the event of your death that can unlock your will. Many people handle their affairs online, from taxes to insurance to healthcare and every day business, such as the electricity and water bills. Can the person you are sharing your life with, step in and take over what you do? What about your digital content such as online magazines, blogs, or any other intellectual digital property. Does someone know what to do with your digital content?

What would a digital will look like and what would be the most important steps needed to secure your digital afterlife?

First, let us look at your mobile device, phone, iPad or tablet? Does someone have access to unlock your digital devices? Once in your digital device, are there items that you would want deleted or shared? You are giving someone access that you trust will do what you want them to do.

Second, what about your laptop or computer? What are the passwords to gain access to your computer? Is it bio-metric access only, such as a finger swipe? Consider having another option to access your laptop, in addition to bio-metric. Once in your computer, are there files that you want deleted? Do you have content that you want shared? Are there letters that you want distributed after you are gone? Photographs that are earmarked for some person in particular, that you want to make sure they receive after you are gone? Think about making a file, clearly labeled for your digital executor to be able to execute your desires.

Third, what about your email? Often email is correspondence of deeper thought that is shared in confidence, not to be announced to the world. How would you like your email to be handled? Many times on the road, we will stop at a second hand store were Jill will find old post cards and letters that not only document a moment in a person’s life, but also history! Maybe, you do not want your account and all your email deleted. Think about the reason you are keeping some of your older email and decide how you want to handle it, in the event of your death or that you are incapacitated.

Fourth, what to do with your social media profiles? Facebook has an option that you can be memorialized, but you can also have your account deleted. Other social media sites have similar options and should be considered when thinking about your digital afterlife.

Fifth, the top four items deal with your personal digital life, this next item is truly about others in your life that will need to handle your financial affairs. I always remember a dear friend in her eighties lost her husband and was truly lost when it came to their financial life. You do not want to put this burden on the person you love who is mourning you! This step is the most important step, because life has become so digitized. It is absolutely necessary that your loved one has access and knows all the financial accounts, insurance, and any other monetary digital asset that you were managing. Keep an encrypted digital document of the financial institution, account number, user name and password. It is also a good idea to establish the amount of money that should be in the account. Ideally, these digital assets should be edited every six months, even if there is little to no change; it is a good digital checkmark.

Final steps to consider, online shopping accounts should be deleted, especially if you have credit cards stored in your profile, and unfortunately your online media, such as books, movies and music are not actually yours, and the license expires upon your death, but your account should also be deleted.

Your digital legacy is in your hands. How do you want your digital life to be summed up and remembered? It is truly up to you and you should make it known. Today, we need to think of every aspect as we allow someone to take over our digital identity to make sure that it is completed with digital dignity. Stay safely connected, even after you die.